Takaful Vs Conventional Insurance

Insurance and Takaful are essential for financial planning. Takaful Insurance vs Conventional Insurance.

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

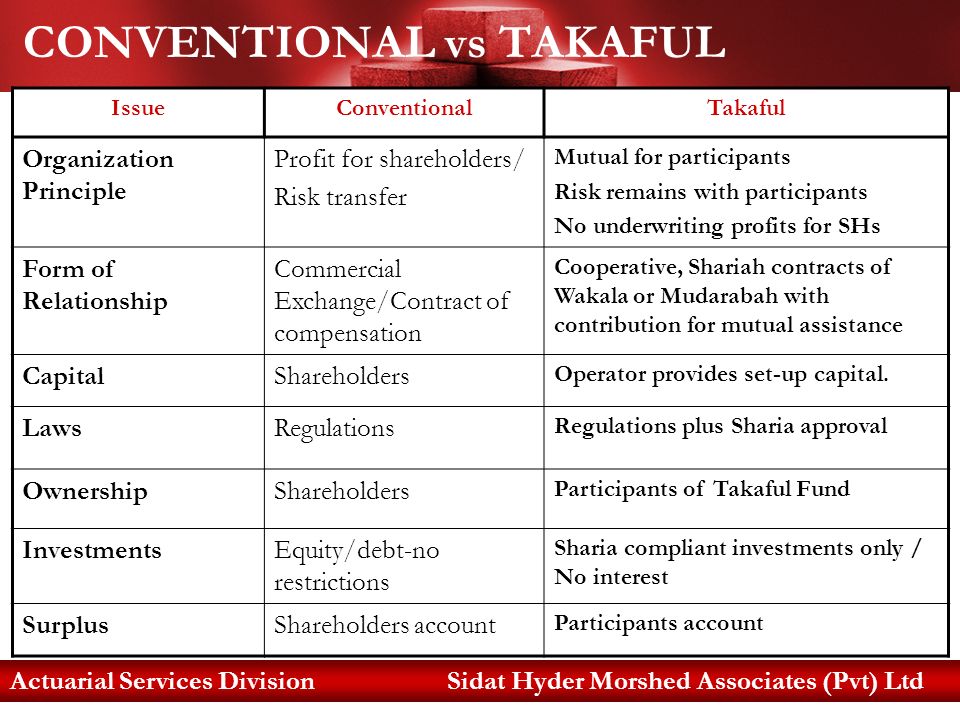

Any surplus that occurs from the invested funds is distributed to the participants and the Takaful operator.

. Takaful have other key features that set them apart from conventional insurance products. Meanwhile both participants and shareholders get a distribution from the profits from investments. In present-day business one of the approaches to diminish the danger of misfortune because of incidents is through insurance.

Key Points There are a few differences and similarities between conventional insurance and Takaful. Leave a Reply Cancel reply. While both takaful and conventional insurance provide similar resultsprotection from lossesthe methods behind each are different.

Takaful touches on points crucial to adapting to the current digital trends in the banking sector. Takaful is fundamentally different from conventional insurance The idea of Takaful is similar to conventional insurance and shares the same fundamental roots. Takaful vs Conventional Insurance.

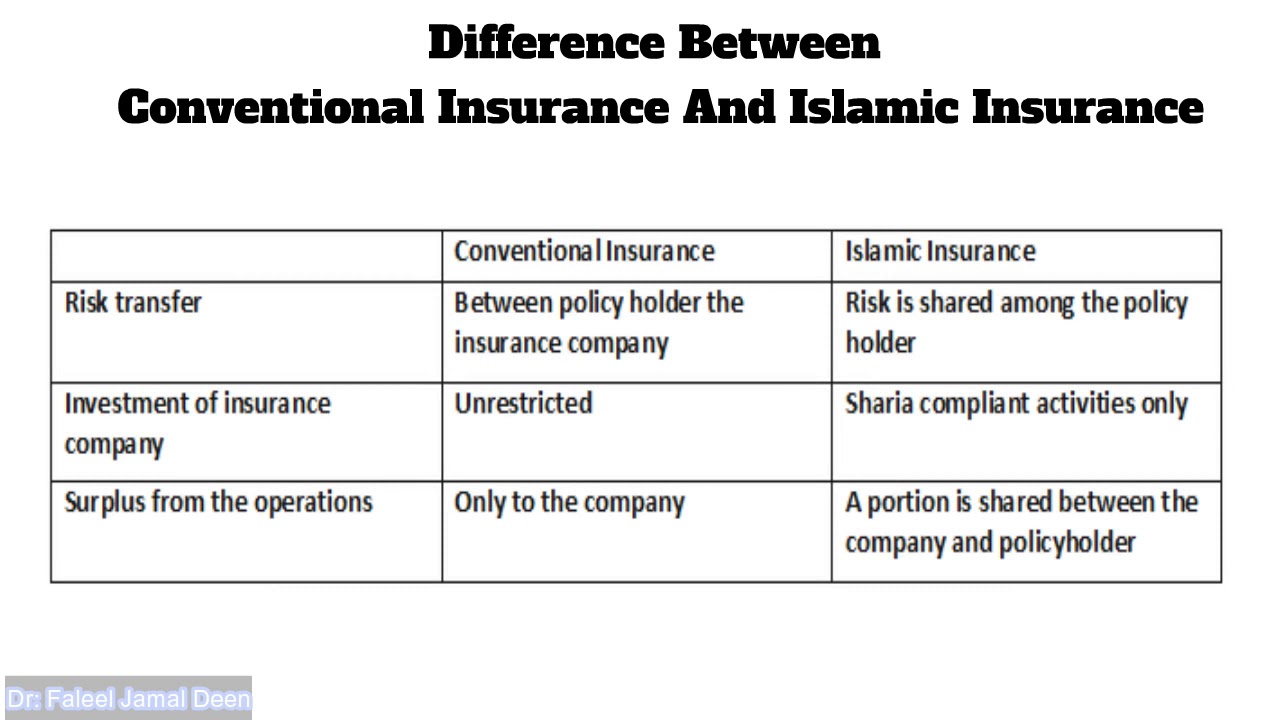

Remember that since Takaful claims are paid from the community pool. The main difference between conventional insurance and Takaful is that the former is a risk-transfer model whereas the latter is a risk-sharing model. Under the takaful policy the funds will be distributed among the participants.

While there are many similarities between Takaful and conventional insurance a takaful company ensures that its products and operations are in accordance to Shariah principles. In takaful the risk is reduced within a. On the contrary under conventional insurance only shareholders get the profit.

A The takaful company exists for reasons other than to profits its stockholders In. A quick comparison offers some more hints as to why Takaful is becoming more and more popular. The Certificate of Specialisation Conventional Insurance vs.

Muslims are advised to. What makes Takaful contracts totally unique compared to conventional insurance contracts is that the latter is based on the exchange of risk whereas the former is based on the. Your email address will not be published.

Here are four reasons why Takaful is better than conventional insurance. Conventional Insurance involves making investments that can incur risk and generate profits that will be retained by the company while under Takaful Investment profits are distributed. Prerequisites All you need to.

And it is totally against the profit and loss sharing concept in Islamic Finance. The idea of insurance. Unlike conventional insurance which risk is transferred from the insured to the insurer the Takaful Insurance mutual risk is shared amongst the participants.

Much like conventional insurance there are many different types of Takaful plans covering life protectionfamily Takaful medical education and investment among others. You get profit instead of a bonus All participants and shareholders share profits from investments.

Conventional Insurance Takaful Concept Takaful Rules Retakaful Ppt Video Online Download

Takaful Islamic Insurance Vs Conventional Insurance Youtube

Takaful Insurance Gulf Insurance Brokers Llc

Takaful And Conventional Insurance Copy 01 The Money Doctor

How Does Takaful Compare To Conventional Insurance

What Difference Between Takaful Vs Conventional Insurance Mi Adviser

0 Response to "Takaful Vs Conventional Insurance"

Post a Comment